- Top

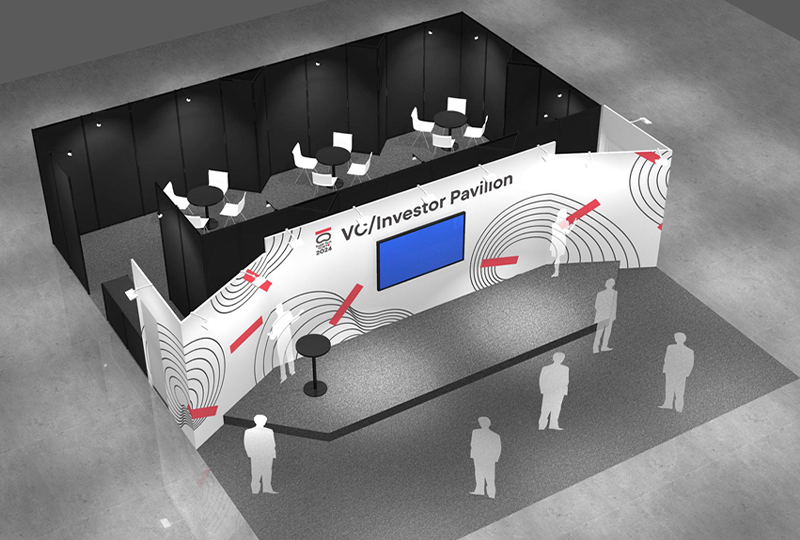

- VC/Investor Pavilion

What is VC/Investor Pavilion?

- Creating "New Encounters" with VC Investors for Startup Evolution

Pavilion Image

Pavilion Contents

-

Meetup Space・Startups participating in the event can utilize the space for casual networking and exchanging ideas.

Meetup Space・Startups participating in the event can utilize the space for casual networking and exchanging ideas.

・ VC, CVC, and investors can use the space on a rotating basis

・Investors staying in the space can meet and discuss with other investors and discuss financing opportunities.

-

Mini Stage・Stage for VC, CVC, and investors to disseminate information.

Mini Stage・Stage for VC, CVC, and investors to disseminate information.

・Anyone is welcome to drop by and participate as an audience member.

Pavilion Timetable

- Meetup Space

Timetable -

5.15(Wed)

5.16(Thu)

- Mini Stage

Timetable -

-

5.15 (Wed)

-

5.16 (Thu)

-

Company Mini Stage Overview Speakers 11:00 Silicon Valley Ventures Co., Ltd - The perspective of high-profile overseas micro-VCs (Silicon Valley & India, Switzerland & Africa)

- Based on the current trends of the hottest overseas micro-VCs, we will share with you where and in what areas of the world technology is gaining momentum. By capturing the perspectives of VCs investing in global startups, we will explore the possibilities for future overseas investment. We look forward to your participation if you are interested in overseas VC and investment in overseas startups.

11:30 Remarkable Ventures Climate - Remarkable Ventures Climate: Investing in Climate Tech Globally from NYC

- Explanation of our VC fund with Japanese LPs and our network and platform that help our portfolio companies. Why we are investing in Japanese climate tech startups and why it is important to increase the capital for climate venture capital.

12:00

(12:10-12:40)Mitsubishi UFJ Trust and Banking Corporation - Roadmap to Tokyo Stock Exchange for Foreign Startups -Cross Border IPO-

-

Are you thinking about listing your

company or your portfolio companies

on a stock market in Asia with high

liquidity and valuation?

Tokyo Stock Exchange is one of the markets which you may consider.

This event aims to support foreign startups and VC by providing a broad and focused information. We hope you will take advantage of this opportunity.

13:00 Venionaire Capital - Austria – the hidden champion of start-up hubs in Europe

- Explore the dynamic ecosystem fostering innovation and entrepreneurial spirit that makes Austria a powerhouse in the European startup landscape.

13:30 UB Ventures, Inc - Issues and potential innovations that can be expected in a Depopulating Society

-

Japan is entering a population

decline faster than any other

country in the world. This has led

to a shortage of labor in legacy

industries such as construction,

manufacturing, and logistics,

becoming a significant societal

challenge. However, the experience

of population decline, unique to

Japan on a global scale, can also be

seen as an opportunity. As countries

around the world will eventually

face population decreases, the

innovations emerging from Japan are

filled with vast potential.

UB Ventures, which invests in innovations for societies experiencing population decline, would like to introduce you to the challenges and the innovation potential.

14:00 Decima Fund - The establishment of Decima Fund and what we aim to achieve in Japan

- Overview of Decima Fund

14:30 LAC Co., Ltd. - Introduction of our CVC startup investment activities and introduction of future activities

- We will introduce our investment activities in startup companies conducted from 2018 to 2023, discuss the achievements of our company, insights gained from these activities, and our further expectations for startup companies. Finally, we will present our future activity policy.

15:00 Alchemist Accelerator - Inside the VC mind presented by the leading US accelerator

- The CEO and director of the global program of a leading US accelerator with a vast global network, will share insights into the VC mindset. Whether you're a startup aiming for global success or a VC or company seeking collaborations with international investors, this is a must-attend event! Let's join the meet-up space available both before and after the mini-stage too.

15:30 Spiral Capital, Inc. - Startup funding deals in Japan -Web3/NFT, Climate Tech, Open Innovation-

- Spiral Capital is a venture capital firm supporting startups, including open innovation to promote industrial transformation in Japan. In this session, we will introduce startup funding deal trends in Japan related to Web3/NFT, Climate Tech, and open innovation, as well as Spiral Capital's investment activities.

16:00 16:30 Hunch Ventures & Investments Pvt. Ltd. - Land of Opportunity: Why India Should Be Your Next Business Destination

-

India's booming economy, vast talent

pool, and tech-savvy population

offer a goldmine of potential.

• Massive Market Access: Reach a consumer base of 1.4 billion with rising purchasing power.

• Favorable Startup Ecosystem: Benefit from government incentives, a vibrant VC scene, and a supportive infrastructure.

• Innovation Collaboration: Partner with Indian talent to co-create solutions for global markets.

• Access to Capital: Build your investor network in India

17:00 17:30 -

Company Mini Stage Overview Speakers 10:00 Startup Genome - Global Hypergrowth Tokyo session

- Michael Jackson will meet with startups who are eager to go global.

10:30 Scrum Ventures LLC - Scrum Ventures: Accelerating innovation around the world

- Join us for a 30-minute discussion where we will introduce Scrum Ventures Group, showcase our portfolio and highlight selected startups. We will also introduce our thematic co-creation activities with Japanese corporates, our new accelerator program, and our Japan Entry Support that we have provided to global startups.

11:00 Niremia Collective - Revolutionizing Wellness: Silicon Valley's Latest in Wellbeing Tech

- Discover the forefront of wellness innovation straight from Silicon Valley. Dive into groundbreaking technologies shaping the future of wellbeing, from personalized health apps to AI-driven wellness platforms. Join us to explore the latest trends and transformative advancements revolutionizing the wellness industry.

11:30 D4V - Startups and Design in the Age of AI

- The age of AI is here, and it's transforming the way startups approach design and innovation. Hosted by the design-focused venture capital firm D4V (Design for Ventures), this session will explore the intersection of startups, design, and the transformative impact of artificial intelligence.

12:00 CDIB Capital Innovation Advisors - Know about CDIB Cross Border Innovation Fund

- CDIB set up the CDIB Capital Innovation Accelerator / Fund in 2017 and CDIB Tokyo Innovation Hub in 2023. Our investment strategy focuses on DX, AI / Blockchain, Mobile Commerce. By providing abundant resources, including financial holding, venture capital, industry networking, mentorship, social community and media, the CDIB Innovation Accelerator / Fund supports start-up companies’ growth and expansion into global markets.

12:30 13:00 13:30 14:00 14:30 Bosch Ventures - Open Bosch

- Open Bosch: Win-Win partnership. We make partnering with startups easy. Let's collaborate to make a big impact together.

15:00 SDG Impact Japan Inc. - Introduction for impact focused ventrue capital activities in the are of Agri/Food Tech Gender-Lens&Healthcare

- Introduction of SDG Impact Japan focusing on our thematic investment funds across Agri/Food tech and Gender-Lends/Healthcare tech startups

15:30 PULSAR - Unleashing Innovation from Eastern Europe: Disruptive Technologies Challenge the Japanese Market (Tentative)

-

Eastern European countries have

established a thriving startup

ecosystem, earning them the moniker

of "Europe's Silicon Valley." This

region boasts a wealth of

prestigious universities that

produce exceptional talent in

mathematics and computer science,

attracting research and development

centers from Western tech giants.

This event brings together three prominent CEOs of Eastern European startups entering into the Japanese market. They will showcase their companies' groundbreaking technologies and services, along with their strategies for success in Japan. Additionally, the event will explore case studies and challenges associated with Eastern European startups operating in the Japanese market.

16:00 East Ventures - East Ventures and the Southeast Asian Tech Ecosystem: General Landscape of VC and Startups Today and Tomorrow

- Explore East Ventures' role as a leading VC fund in Southeast Asia, managing US$1.7 billion in AUM with four unicorns in the portfolio. General introduction into the region's thriving tech ecosystem, propelled by population bonus and a burgeoning digital economy.

16:30 ANRI Inc. - Introducing "UNLOCK by ANRI," Japan's first female entrepreneur investment program, and "TOKYO PRIZE," Japan's largest prize for carbon reduction R&D business

- Introducing "UNLOCK by ANRI," Japan's first program specializing in female entrepreneurs, accelerating DE&I in the startup industry. Also, presenting "TOKYO PRIZE carbon reduction," a research and development initiative under Tokyo SUTEAM project, offering a total prize of 0.1 BJPY.

17:00

-